Your accountant will often produce a set of accounts that include a balance sheet. But what exactly is this? It is a common misconception that the profit is the only factor you need to worry about.

Actually the balance sheet is very important. It provides a summarised snapshot of the business assets and liabilities at a particular date in time. Whilst not necessarily an accurate way of valuing a business it can be a very good starting point. It is particularly relevant to Limited Companies as they require this information to be reported in the annual accounts, even for a small entity.

What should it look like?

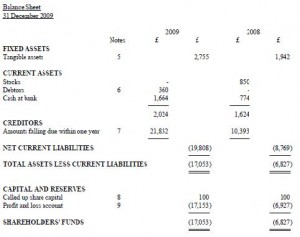

The format of the balance sheet is generally set out by Company rules; however, it will generally include, in this order:

- Fixed Assets – items held with a longer useful life, such as plant and machinery

- Current assets – short term beneficial items that are very ‘liquid’ such as stock for resale, debtors and cash held

- Current liabilities – short term amounts outstanding such as, bank overdrafts, trade creditors and taxes due

- Long term liabilities – amounts owed but repayable over longer periods such as bank loans and hire purchase amounts

These make up the ‘top half’ of the balance sheet and is known as the net assets. The ‘second half’ is the capital section which shows the way the company has been funding. This is predominantly made up of two items, share capital and Reserves. Reserves are profits that have accumulated over the life of the company. The top half should always equal the bottom half – hence balance sheet. The balance sheet can be a very useful tool helping analyse and improve the management of your business. It can show the ‘solvency’ of a business and how ‘liquid’ its assets are. Just to explain these terms in English:

- Solvency – a business assets should always be more than its liabilities; This indicates its ability in which to repay its creditors. Should a balance sheet be negative this could give cause for concern to anyone who is owed money by it.

- Liquidity – the ability to convert assets into cash quickly. It is assumed stock for resale and debtors are relatively quick to convert. If there are any issues stock valuation may need to be written down or debtors written off. This will reduce the positive value of the company.

It is therefore advisable to keep an eye on your balance sheet at all times and perhaps look at preparing quarterly or monthly management accounts. It is often too late to find out if there is a problem after the accounts have been done.

Speak to your accountant or get in touch with PAH Accounting if you feel you don’t understand what this all means. It will add value to your business to know the facts! We can also help with your bookkeeping or management accounts.